SCENARIO 11-2

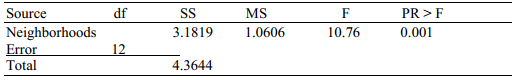

A realtor wants to compare the mean sales-to-appraisal ratios of residential properties sold in four neighborhoods (A,B,C,and D) .Four properties are randomly selected from each neighborhood and the ratios recorded for each,as shown below.

A: 1.2,1.1,0.9,0.4

C: 1.0,1.5,1.1,1.3

B: 2.5,2.1,1.9,1.6

D: 0.8,1.3,1.1,0.7

Interpret the results of the analysis summarized in the following table:

-Referring to Scenario 11-2,what should be the decision for the Levene's test for homogeneity of variances at a 5% level of significance?

Definitions:

Tax Incidence

The study of who ultimately bears the burden of a tax, which can differ from who the tax is initially levied upon.

Tax Burden

The measure of taxes that an individual or business must pay out of their income or profit.

Tax Incidence

The analysis of the effect of a particular tax on the distribution of economic welfare among entities in the market.

Imported Wine

Wine that is produced in one country and then shipped to and sold in another country.

Q7: Referring to Scenario 13-4, the managers of

Q12: Referring to Scenario 8-10, construct a 95%

Q17: Referring to Scenario 10-10, construct a 90%

Q18: Referring to Scenario 12-6, what is the

Q25: Referring to Scenario 8-6, it is possible

Q51: Referring to Scenario 10-5, you must assume

Q76: True or False With a test being

Q95: Referring to Scenario 10-10, construct a 99%

Q148: Referring to Scenario 8-6, it is possible

Q209: Referring to Scenario 11-5, the within-group variation