SCENARIO 11-2

A realtor wants to compare the mean sales-to-appraisal ratios of residential properties sold in four neighborhoods (A,B,C,and D) .Four properties are randomly selected from each neighborhood and the ratios recorded for each,as shown below.

A: 1.2,1.1,0.9,0.4

C: 1.0,1.5,1.1,1.3

B: 2.5,2.1,1.9,1.6

D: 0.8,1.3,1.1,0.7

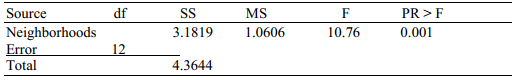

Interpret the results of the analysis summarized in the following table:

-Referring to Scenario 11-2,what should be the conclusion for the Levene's test for homogeneity of variances at a 5% level of significance?

Definitions:

Revolving Line

A type of credit facility that allows a borrower to withdraw, repay, and re-borrow funds up to a specified credit limit.

Commitment Fee

A charge imposed by a lender on a borrower for not utilizing a credit line or for funds that have not been disbursed.

Revolving Credit

A flexible credit line that allows individuals or businesses to borrow, repay, and borrow again up to a certain limit, commonly seen in credit cards and lines of credit.

Interest Expense

It refers to the cost incurred by an organization or individual for borrowing funds, typically represented as a yearly interest rate applied to the loan's principal amount.

Q12: Referring to Scenario 8-10, construct a 95%

Q52: Referring to Scenario 11-6, using an overall

Q72: Referring to Scenario 10-4, a two-tail test

Q75: Referring to Scenario 13-4, the managers of

Q99: Which of the following procedures would you

Q119: Which of the following is an assumption

Q134: Referring to Scenario 8-8, it is possible

Q134: Referring to Scenario 12-10, which test would

Q194: Referring to Scenario 11-10, the mean squares

Q210: Referring to Scenario 11-10, the F test