SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

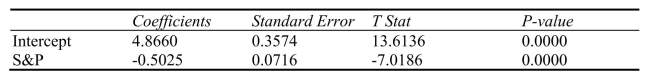

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (  X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the  p-value of the associated test statistic is ______

p-value of the associated test statistic is ______

Definitions:

Opportunities

Circumstances that present a chance for advancement, success, or profit.

Departmentalization

Process of dividing work activities into units within the organization.

Functional

relates to the specific roles and activities designed to achieve objectives within an organization, often grouped by department like marketing or finance.

Production

The process of creating, manufacturing, or producing goods and services.

Q21: Referring to Scenario 11-4, state the null

Q75: Referring to Scenario 11-6, based on the

Q83: Referring to Scenario 15-3, suppose the chemist

Q111: Referring to Scenario 11-3, the test is

Q121: Referring to Scenario 14-17, you can conclude

Q200: Referring to Scenario 13-10, the value of

Q212: Referring to Scenario 11-7, what is the

Q212: Referring to Scenario 13-3, suppose the director

Q277: Referring to Scenario 14-17, the null hypothesis

Q316: Referring to Scenario 14-15, which of the