SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (

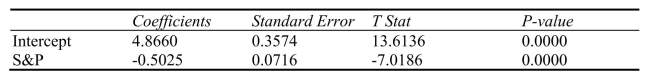

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (  X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the  p-value of the associated test statistic is ______

p-value of the associated test statistic is ______

Definitions:

Crystallized Intelligence

The ability to use skills, knowledge, and experience acquired over a lifetime, often increasing with age.

Visual-motor Abilities

Skills that involve coordination between visual perception and motor control, supporting tasks like writing and catching a ball.

G Factor

Spearman’s term for a general intellectual ability that underlies all mental operations to some degree.

S Factor

Also known as the "specific factor," it refers to specific mental abilities as opposed to general intelligence in psychometric testing.

Q1: Referring to Scenario 14-19, there is not

Q6: Referring to Scenario 15-3, suppose the chemist

Q28: Referring to Scenario 11-8, what is the

Q47: Referring to Scenario 14-19, what is the

Q112: Referring to Scenario 13-2, to test that

Q127: Referring to Scenario 12-6, what is the

Q146: Referring to Scenario 13-10, what are the

Q192: Referring to Scenario 13-1, interpret the estimate

Q222: Referring to Scenario 14-15, the alternative hypothesis

Q240: Referring to Scenario 14-5, what is the