SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

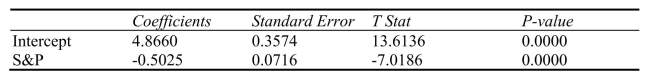

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (  X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, which of the following will be a correct conclusion?

Definitions:

Lignite Coal

A soft brownish coal showing traces of plant structure, the lowest grade of coal due to its relatively low heat content.

Bituminous Coal

A type of coal noted for its relatively high energy and carbon content, used primarily for electricity generation and steel production.

Superinsulation

An approach to building design and construction that greatly increases thermal resistance, significantly reducing heating and cooling demands.

Active Solar Heating

A system that uses solar energy to heat a fluid (either liquid or air), transferring this heat to the interior of a building or to a storage tank for later use.

Q10: Referring to Scenario 12-7, the decision made

Q23: Referring to Scenario 14-18, which of the

Q26: If the correlation coefficient (r)= 1.00, then<br>A)the

Q80: Referring to Scenario 13-3, suppose the director

Q89: Referring to Scenario 14-16, the 0 to

Q104: Referring to Scenario 14-14, the fitted model

Q117: Referring to Scenario 11-7, the null hypothesis

Q143: Referring to Scenario 14-15, which of the

Q147: Referring to Scenario 13-1, interpret the p-value

Q217: In a particular model, the sum of