SCENARIO 13-12

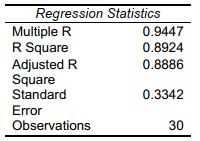

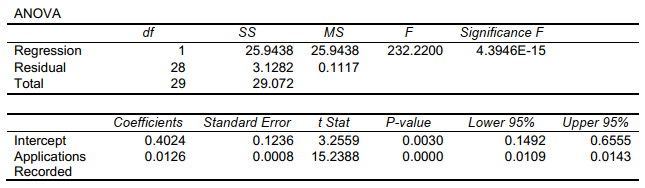

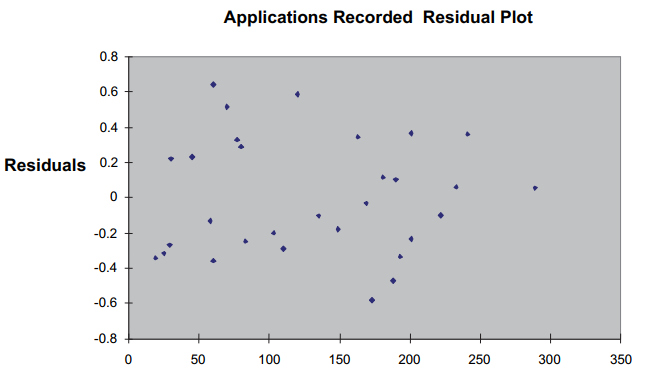

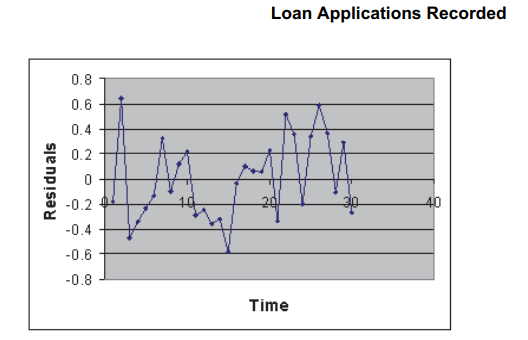

The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan application. Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded. Below is the regression output:

-Referring to Scenario 13-11,what is the p-value for testing whether there is a linear relationship between revenue and the number of downloads at a 5% level of significance?

Definitions:

Probabilities

A measure of the likelihood that a certain event will occur, often expressed as a number between 0 and 1.

Stock Volatilities

Stock volatilities measure the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns, indicating the investment's risk.

Negative Correlation

A relationship between two variables in which one variable increases as the other decreases.

Systematic Correlation

Refers to the relationship between the return of an investment and the return of the market as a whole, often used to assess investment risk.

Q35: Referring to Scenario 13-10, generate the scatter

Q55: Referring to Scenario 14-15, there is sufficient

Q56: Using the best-subsets approach to model building,

Q85: Referring to Scenario 14-3, the p-value for

Q101: Referring to Scenario 14-8, the F test

Q164: Referring to Scenario 14-18, what is the

Q175: Referring to Scenario 14-13, the effect of

Q197: Referring to Scenario 13-4, the total sum

Q200: Referring to Scenario 14-12, what is the

Q269: Referring to Scenario 14-5, one company in