SCENARIO 13-12

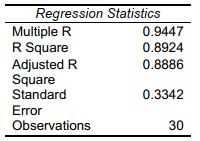

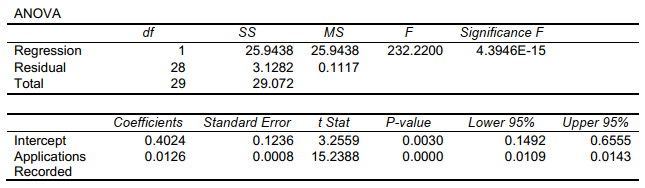

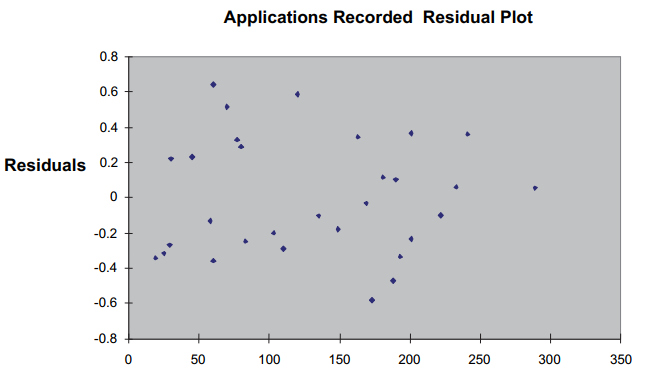

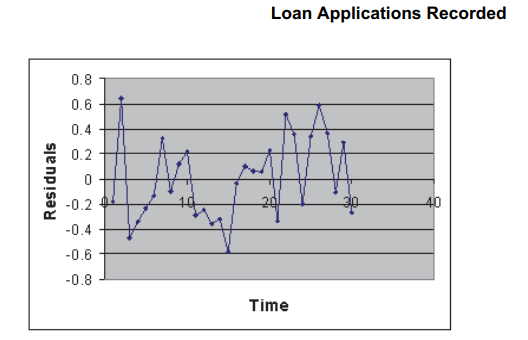

The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan application. Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded. Below is the regression output:

-Referring to Scenario 13-12,the degrees of freedom for the F test on whether the number of load applications recorded affects the amount of time are

Definitions:

Market Price

represents the current price at which an asset or service can be bought or sold in a marketplace.

Bond's Yield

The annual return on a bond investment, calculated by dividing the annual interest payments by the bond's current market price.

Market Interest Rates

The prevailing rate at which borrowers and lenders agree to conduct transactions in the financial markets.

Market Value

The current price at which an asset or service can be bought or sold in a market.

Q46: Referring to Scenario 11-11, interpret the test

Q65: Referring to Scenario 14-2, for these data,

Q101: Referring to Scenario 12-5, what is the

Q118: Referring to Scenario 14-3, to test whether

Q123: Referring to Scenario 14-15, the null hypothesis

Q156: Referring to Scenario 12-1, what is the

Q158: Referring to Scenario 11-6, what are the

Q196: A dummy variable is used as an

Q226: Referring to Scenario 14-15, what is the

Q313: Referring to Scenario 14-15, predict the percentage