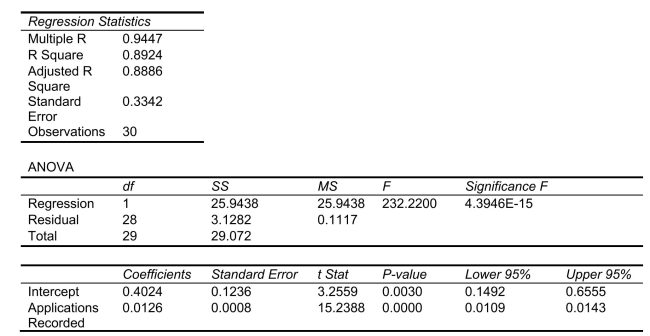

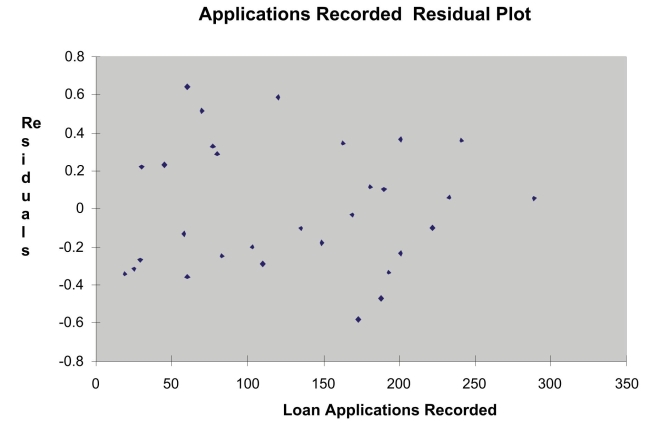

SCENARIO 13-12 The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours)it takes to record a loan application.Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded.Below is the regression output:

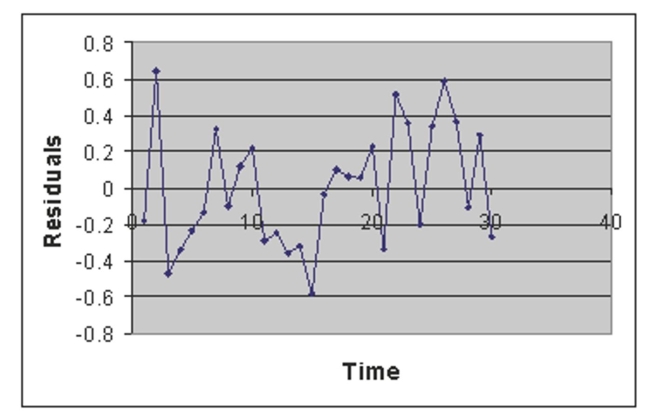

-Referring to Scenario 13-12, there is no evidence of positive autocorrelation if the Durbin-Watson test statistic is found to be 1.78.

Definitions:

Reverse Stock Split

A corporate action that reduces the number of a company's outstanding shares by combining them into a smaller number of shares.

Stock Price

The cost of purchasing a share of a company in the stock market, which fluctuates based on supply and demand, company performance, and market conditions.

Share Repurchases

A process by which a company buys back its own shares from the market, reducing the amount of outstanding stock.

Tax Considerations

The implications of tax laws and regulations on financial decisions and transactions.

Q29: Referring to Scenario 11-7, what is the

Q37: Referring to Scenario 12-9, the calculated test

Q44: Referring to Scenario 15-4, which of the

Q63: The coefficient of multiple determination <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8562/.jpg"

Q70: The following two statements are equivalent in

Q102: In a simple linear regression the best

Q108: Referring to Scenario 13-10, the residual plot

Q150: Referring to Scenario 11-12, the value of

Q215: Referring to Scenario 14-4, when the builder

Q329: Referring to Scenario 14-8, the p-value of