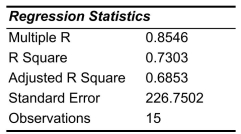

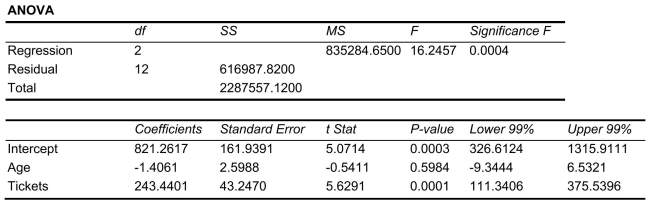

SCENARIO 14-10 You worked as an intern at We Always Win Car Insurance Company last summer.You notice that individual car insurance premiums depend very much on the age of the individual and the number of traffic tickets received by the individual.You performed a regression analysis in EXCEL and obtained the following partial information:

-Referring to Scenario 14-10, to test the significance of the multiple regression model, the null hypothesis should be rejected while allowing for 1% probability of committing a type I error.

Definitions:

Call Provision

A clause in a bond contract allowing the issuer to repay the bond before its maturity date under specific conditions.

Convertible Bond

A type of bond that the holder can convert into a specified number of shares of the issuing company, usually at predetermined times during its life.

Bond Pricing Equation

A formula used to determine the fair price or value of a bond based on its expected cash flows, the face value, and the required rate of return.

Q6: Referring to Scenario 13-8, what are the

Q12: Referring to Scenario 15-6, there is reason

Q23: After estimating a trend model for annual

Q36: Referring to Scenario 12-10, for the cell

Q49: Referring to Scenario 16-11, using the second-order

Q67: Referring to Scenario 12-8, which test would

Q175: Referring to Scenario 12-10, a test was

Q211: Referring to Scenario 14-15, the alternative hypothesis

Q232: Referring to Scenario 14-16, the errors (residuals)appear

Q306: Referring to Scenario 14-6, what can we