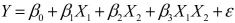

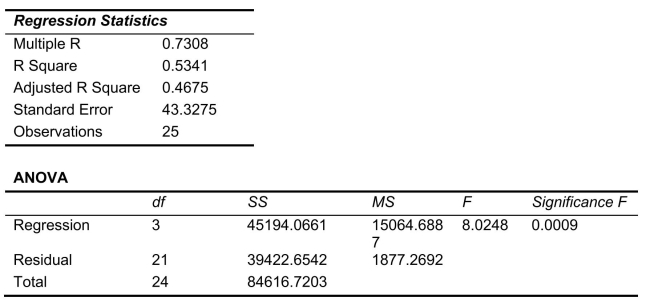

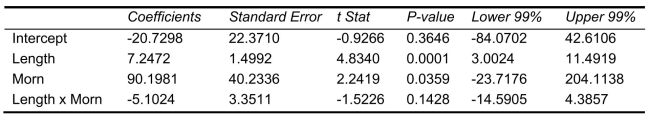

SCENARIO 14-11 A weight-loss clinic wants to use regression analysis to build a model for weight loss of a client (measured in pounds) .Two variables thought to affect weight loss are client's length of time on the weight-loss program and time of session.These variables are described below: Y  Weight loss (in pounds)

Weight loss (in pounds)  Length of time in weight-loss program (in months)

Length of time in weight-loss program (in months)  1 if morning session, 0 if not Data for 25 clients on a weight-loss program at the clinic were collected and used to fit the interaction model: Y

1 if morning session, 0 if not Data for 25 clients on a weight-loss program at the clinic were collected and used to fit the interaction model: Y  Output from Microsoft Excel follows:

Output from Microsoft Excel follows:

-Referring to Scenario 14-11, what is the experimental unit for this analysis?

Definitions:

Mean-Variance Efficient Portfolio

A Mean-Variance Efficient Portfolio is an investment strategy that aims to optimize the balance between expected return and risk, as defined by the portfolio's volatility.

Single-Index Structure

A model used in finance to describe the returns of a security as a function of a single market index.

Expected Returns

A rephrased definition for Expected Return: The anticipated income or profit from an investment over a specific period, considering various possible scenarios and their probabilities.

Variances of Returns

A statistical measure of the dispersion of returns for a given security or market index, showing the degree of variation from the average.

Q3: Referring to Scenario 16-13, what is the

Q34: Referring to Scenario 13-9, to test the

Q55: Referring to Scenario 14-15, there is sufficient

Q66: Referring to Scenario 16-12, using the regression

Q111: Referring to Scenario 13-3, the coefficient of

Q113: Referring to Scenario 14-7, the department head

Q125: Referring to Scenario 13-8, the value of

Q135: Referring to Scenario 14-17, which of the

Q218: Referring to Scenario 14-19, there is not

Q295: Referring to Scenario 14-5, the observed value