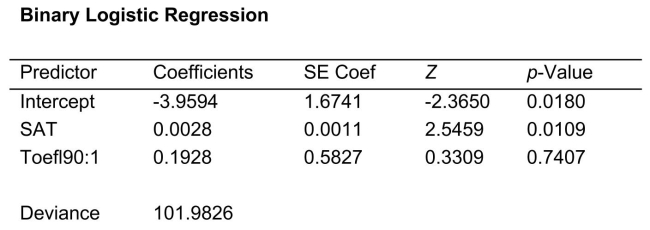

SCENARIO 14-18 A logistic regression model was estimated in order to predict the probability that a randomly chosen university or college would be a private university using information on mean total Scholastic Aptitude Test score (SAT)at the university or college and whether the TOEFL criterion is at least 90 (Toefl90 = 1 if yes, 0 otherwise.)The dependent variable, Y, is school type (Type = 1 if private and 0 otherwise).There are 80 universities in the sample. The PHStat output is given below:

-Referring to Scenario 14-18, what is the estimated probability that a school with a mean SAT score of 1100 and a TOEFL criterion that is not at least 90?

Definitions:

Market Index

A method or metric to measure the performance of a group of stocks, representing a particular market or sector, to give investors a snapshot of its overall health.

Active Portfolio

An investment strategy where the portfolio manager makes specific investments with the goal of outperforming an investment benchmark index.

Nonsystematic Variance

The portion of a security's variance that is unique to the specific security and can be mitigated through diversification.

Market Index

An aggregate value produced by combining several stocks or other investment vehicles together and expressing their total values against a base value from a specific date.

Q37: Referring to Scenario 16-9 and using a

Q56: Which of the following disciplines is typically

Q73: Referring to Scenario 16-12, the best interpretation

Q80: Referring to Scenario 15-6, what is the

Q91: Referring to Scenario 13-10, what is the

Q126: Referring to Scenario 13-4, the managers of

Q131: Referring to Scenario 16-3, if a three-month

Q179: Referring to Scenario 13-12, what are the

Q303: Referring to Scenario 14-1, for these data,

Q317: The owner of a local nightclub has