SCENARIO 14-6

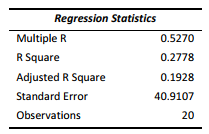

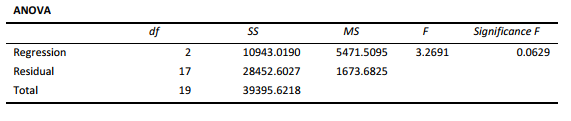

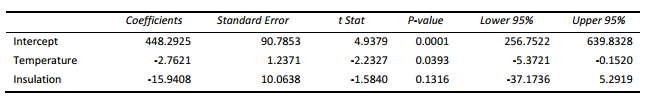

One of the most common questions of prospective house buyers pertains to the cost of heating in dollars (Y) . To provide its customers with information on that matter, a large real estate firm used the following 2 variables to predict heating costs: the daily minimum outside temperature in degrees of Fahrenheit ( X1 ) and the amount of insulation in inches ( X 2 ) . Given below is EXCEL output of the regression model.

Also SSR (X1 | X2) = 8343.3572 and SSR (X2 | X1) = 4199.2672

-Referring to Scenario 14-5,what fraction of the variability in sales is explained by spending on capital and wages?

Definitions:

Strike Price

The set price at which the holder of an options contract can buy (call option) or sell (put option) the underlying asset.

Risk-Free Rate

The theoretical rate of return on an investment with zero risk, often represented by government bonds.

Call Option

A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an asset at a specified price within a specific time period.

Predetermined Price

A price level set in advance for transactions that will occur under specified conditions.

Q7: Which of the following will NOT change

Q32: Referring to Scenario 16-8, the forecast for

Q63: Referring to Scenario 13-11, which of the

Q64: Referring to Scenario 12-3, the expected cell

Q101: Referring to Scenario 13-1, a 95% confidence

Q114: Referring to Scenario 13-11, there appears to

Q153: Referring to Scenario 12-7, the expected cell

Q196: Referring to Scenario 13-10, construct a 95%

Q239: Referring to Scenario 14-6, the coefficient of

Q261: Referring to Scenario 14-16, the 0 to