SCENARIO 14-8

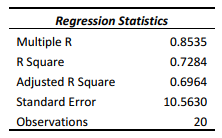

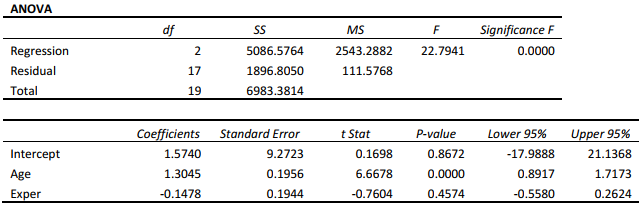

A financial analyst wanted to examine the relationship between salary (in $1,000) and 2 variables: age (X1 = Age) and experience in the field (X2 = Exper). He took a sample of 20 employees and obtained the following Microsoft Excel output:

Also, the sum of squares due to the regression for the model that includes only Age is 5022.0654 while the sum of squares due to the regression for the model that includes only Exper is 125.9848.

-Referring to Scenario 14-8,the estimated change in the mean salary (in $1,000)when an employee is a year older holding experience constant is .

Definitions:

Pure Time Value

Pure time value is the concept in finance that money available now is worth more than the same amount in the future due to its potential earning capacity.

Term Structure

The relationship between interest rates (or yields) and different terms (or maturities) for debt securities.

Liquidity Premium

The additional return that investors require for holding securities with low liquidity, compensating them for the higher risk associated with difficulty in selling the asset quickly at its fair market value.

Term Structure

The relationship between interest rates or yields of different debt instruments, usually depicted by a yield curve showing various maturities.

Q16: Referring to Scenario 16-11, using the first-order

Q17: Referring to Scenario 12-13, if there is

Q60: Referring to Scenario 14-5, what is the

Q89: Referring to Scenario 13-4, the managers of

Q130: If the Durbin-Watson statistic has a value

Q171: Referring to Scenario 16-13, you can conclude

Q231: Referring to Scenario 14-8, the estimate of

Q308: Referring to Scenario 14-5, which of the

Q329: Referring to Scenario 14-8, the p-value of

Q330: If you have considered all relevant explanatory