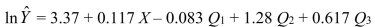

SCENARIO 16-14 A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2011 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-14, in testing the coefficient of X in the regression equation (0.117) the results were a t-statistic of 9.08 and an associated p-value of 0.0000.Which of the following is the best interpretation of this result?

Definitions:

Estimated Bad Debts

A provision for accounts receivable that are not expected to be collected.

Net Income

The total earnings of a company after deducting all expenses, taxes, and costs from its total revenues, indicating the company's profitability.

Liabilities

Financial obligations or debts that a company owes to others, due to past transactions or events.

Net Assets

The residual interest in the assets of an entity after deducting its liabilities, essentially representing the owners' equity.

Q11: Referring to Scenario 16-5, the number of

Q15: Referring to Scenario 16-13, what is your

Q36: Dashboards may contain all but which of

Q52: The fairly regular fluctuations that occur within

Q58: The cause of variation that can be

Q68: Referring to Scenario 16-13, what is the

Q71: Some business analytics involve starting with many

Q89: Being able to monitor business activities in

Q206: Referring to Scenario 18-3, the analyst decided

Q321: Referring to Scenario 14-16, what is the