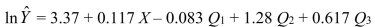

SCENARIO 16-14 A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2011 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-14, in testing the coefficient for  in the regression equation (- 0.083) , the results were a t-statistic of - 0.66 and an associated p-value of 0.530.Which of the following is the best interpretation of this result?

in the regression equation (- 0.083) , the results were a t-statistic of - 0.66 and an associated p-value of 0.530.Which of the following is the best interpretation of this result?

Definitions:

Monopolistically Competitive Firm

A firm that operates in a market with many competitors, each offering a slightly different product.

Profit-Maximizing Quantity

The level of production at which a firm achieves the highest possible profit, where marginal revenue equals marginal cost.

Marginal Revenue

Marginal Revenue refers to the increase in revenue resulting from the sale of one additional unit of a product or service.

Marginal Cost

The growth in the total amount of costs resulting from the manufacture of one more unit of a good or service.

Q28: In selecting a forecasting model, you should

Q29: In the United States, the control limits

Q51: Referring to Scenario 17-1, the sparklines enable

Q124: Referring to Scenario 16-5, the number of

Q131: Referring to Scenario 18-8, there is sufficient

Q160: Referring to Scenario 14-8, the analyst wants

Q165: Referring to Scenario 18-9, _ of the

Q245: Referring to Scenario 14-19, what is the

Q262: A wheel spinning game is played with

Q317: The owner of a local nightclub has