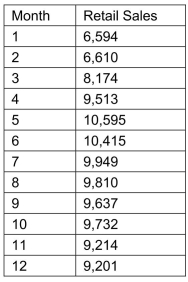

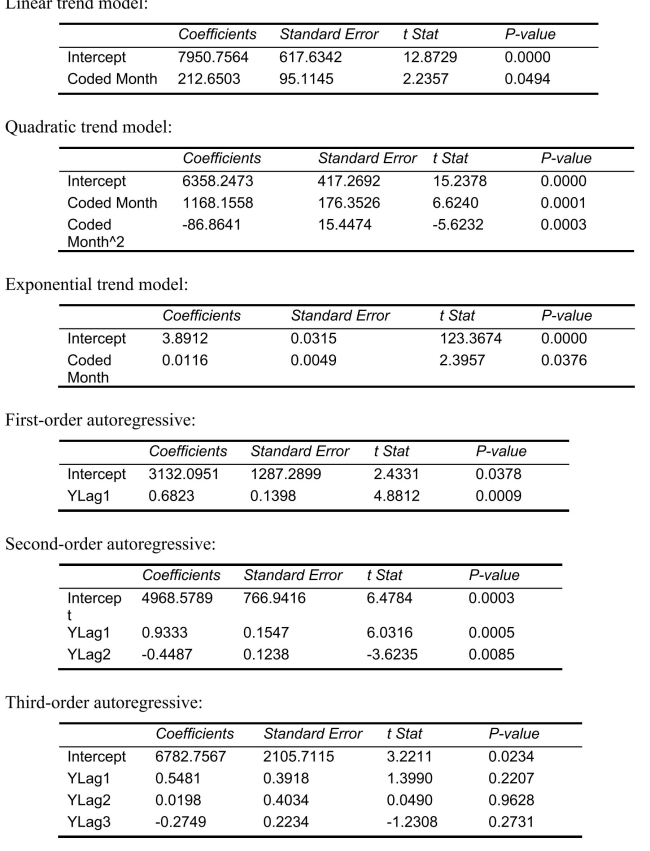

SCENARIO 16-13 Given below is the monthly time series data for U.S.retail sales of building materials over a specific year.  The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the  month is 0:

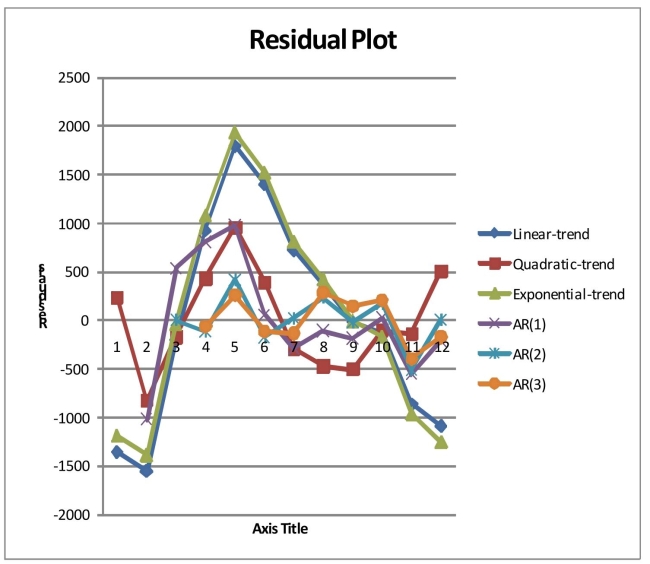

month is 0:  Below is the residual plot of the various models:

Below is the residual plot of the various models:

-Referring to Scenario 16-13, what is the exponentially smoothed value for the 1  month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 1

month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 1  and 1

and 1  month are 9,746.3672 and 9,480.1836, respectively?

month are 9,746.3672 and 9,480.1836, respectively?

Definitions:

Notes Receivable

Short-term or long-term financial assets representing amounts owed to the company that are documented through formal agreements or promissory notes.

Interest Revenue

This refers to the income that is earned from investments, loans, or savings accounts, essentially any source that pays interest.

Noninterest-Bearing Note

A promissory note that does not accrue interest over its lifetime, meaning the borrower repays only the principal amount.

Current Interest Rates

Current interest rates are the rates at which interest is paid by borrowers for the use of money that they borrow from lenders.

Q1: Referring to Scenario 18-10 Model 1, which

Q26: Referring to Scenario 18-3, the analyst wants

Q28: Referring to Scenario 18-3, the value of

Q32: Referring to Scenario 18-9, the 0 to

Q96: Referring to Scenario 18-5, the multiple regression

Q160: Referring to Scenario 16-5, the number of

Q172: Referring to Scenario 18-1, which of the

Q215: Referring to Scenario 18-12, what is the

Q262: The interpretation of the slope is different

Q278: To test the effectiveness of a business