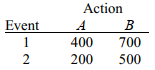

SCENARIO 20-2

The following payoff matrix is given in dollars.

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2,the EMV for Action A is

Definitions:

Bond Portfolio Management

The process of creating and managing a portfolio of bonds to achieve specific investment objectives, such as income generation or capital preservation.

Asset Matching

A strategy used in portfolio management that involves matching the durations of assets and liabilities to mitigate risk.

Duration Matching

A strategy used in portfolio management to align the durations of assets and liabilities, reducing interest rate risk.

Bond Portfolio Management

The process of creating and managing a collection of bonds to achieve specific investment objectives, taking into account factors like risk tolerance, return requirements, and liquidity needs.

Q24: Referring to Scenario 20-6, what is the

Q33: Referring to Scenario 19-4, suppose the sample

Q66: Referring to Scenario 18-10 Model 1, _

Q92: Referring to Scenario 19-6, a p control

Q146: Determining the root causes of why defects

Q175: Referring to Scenario 18-3, the analyst wants

Q179: Referring to Scenario 18-3, the analyst wants

Q212: Referring to Scenario 18-9, what is the

Q254: Referring to Scenario 18-3, the analyst wants

Q278: To test the effectiveness of a business