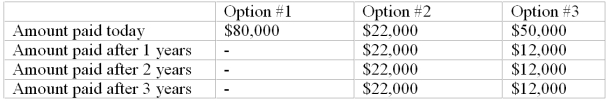

Suppose that you have a winning lottery ticket for $100,000. The State of California doesn't pay this amount up front - this is the amount you will receive over time. The State offers you two options. The first pays you $80,000 up front and that will be the entire amount. The second pays you winnings over a three year period. The last option pays you a large payment today with

small payments in the future. The payment options are detailed in the table below:

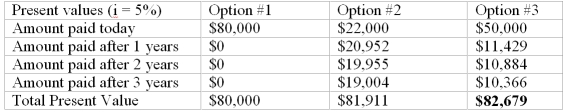

Compute the present value of each payment option, assuming the interest rate is 12%. Now, compute the present values based on an interest rate of 5%. Compare your answers, explaining why they are different when the interest rate changes. When the interest rate is 5%, the present values are as follows:

Definitions:

Q14: If a bond's rating improves, we would

Q26: In the chapter you read that it

Q43: Why isn't the actual level of an

Q52: Which of the following best expresses the

Q67: Explain why insurance companies may find themselves

Q69: Bond prices and yields:<br>A) move together in

Q77: A stock currently does not pay an

Q100: Comparing a lottery where a $1 ticket

Q101: Developing a program to prevent underage drinking

Q115: Most home mortgages are good examples of:<br>A)