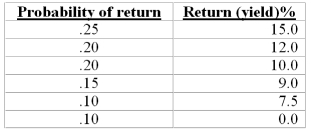

An individual faces two alternatives for an investment. Asset 'A' has the following probability of return schedule:

Asset 'B' has a certain return of 10.25%. If this individual selects asset 'A' does it imply she is risk averse? Explain.

Definitions:

International Trade

The exchange of goods and services across international boundaries or territories, involving the import and export of products.

Opportunity Cost

The worth of the best alternative that is given up in order to make a choice.

Imports

Products or services imported from other countries for sale or consumption.

Purchasing Power

The value of currency expressed in terms of the amount of goods or services that one unit of money can buy.

Q1: If a one-year bond currently yields 4%

Q6: As the volatility of the stock price

Q20: We would expect the risk spread between

Q22: Stock market bubbles impact consumers by:<br>A) encouraging

Q31: Briefly explain the difference between idiosyncratic risk

Q41: Which of the following statements is not

Q80: Explain the difference between civil and criminal

Q88: A student receives a five-year loan to

Q110: How did asset backed commercial paper (ABCP)

Q120: Explain why the bid-ask spread on most