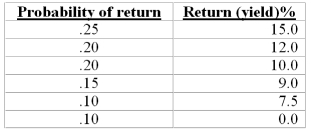

An individual faces two alternatives for an investment. Asset 'A' has the following probability of return schedule:

Asset 'B' has a certain return of 10.25%. If this individual selects asset 'A' does it imply she is risk averse? Explain.

Definitions:

Institutional Power

The authority and influence possessed by an organization, enabling it to control or direct societal or organizational outcomes.

Market Share

The proportion of an industry's sales that is earned by a particular company over a specified time period.

John Schnatter

The founder of Papa John's Pizza, an American pizza restaurant franchise.

Expanding Internationally

The process by which a business extends its operations and market reach beyond its home country, entering new geographic markets.

Q3: The New York Stock Exchange is an

Q4: A credit card that charges a monthly

Q11: The usually upward sloping yield curve indicates

Q44: Professor Jeremy Siegel, of the University of

Q50: A put option that is described as

Q62: There's a call option written for 100

Q66: Considering the concept of compounding, explain why

Q80: What is the equivalent tax-exempt bond yield

Q84: The value of money as a means

Q103: What is the probability of tossing a