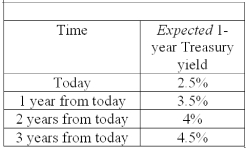

Using the information provided and the expectations hypothesis, compute the yields for a two-year, three-year, and four-year bonds.

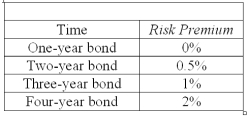

Now, suppose there is a risk premium attached to each bond. These risk premiums are given in the table below:

Using the information above and the liquidity premium theory, compute the yields for a two- year, three-year, and four-year bonds. How does this yield curve compare to the one you computed using the expectations hypothesis?

Definitions:

Rate of Return

Rate of return is the gain or loss on an investment over a specified period, expressed as a percentage of the investment's initial cost.

Dividend Remains

Indicates the portion of earnings that a company decides to retain rather than distribute to shareholders as dividends.

Annual Dividend

The total dividend payment a shareholder receives from a company in a single year.

Market Rate of Return

The average rate of return that investors expect to earn in the financial markets from an investment, reflecting the risk compared to the risk-free rate.

Q12: A saver knows that if she put

Q18: Examples of economies of scale are:<br>A) the

Q24: Discuss how changes in economic conditions are

Q28: Unique risk is another name for:<br>A) market

Q32: Considering the balance sheet for all commercial

Q38: If a bond has a face value

Q52: If the euro/U.S.dollar exchange rate is 1.1€/U.S.

Q53: As the time of settlement gets closer:<br>A)

Q82: Risk-free investments have rates of return:<br>A) equal

Q104: In mid-2004 there was speculation that the