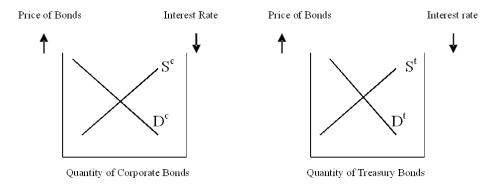

Please use the graphs to show what happens to the risk (yield) differential in each situation and why.

Assume the corporate and Treasury bonds have the same maturity;

a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?

b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?

c) If the corporate bonds are granted tax-exempt status, what happens in each market?

d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

Definitions:

Realization

The act of becoming fully aware of something as a fact or understanding a concept completely.

Open to Experience

A personality trait describing individuals who are imaginative, curious, and open-minded toward new experiences.

Neurotic

A characteristic of personality marked by fluctuations in emotion, anxiousness, shifts in mood, concerns, and apprehension.

Creativity

The ability to generate new ideas, solutions, or products that are both novel and appropriate.

Q9: The Standard & Poor's 500 Index:<br>A) gives

Q36: The reason financial intermediaries play such an

Q44: What is the highest bond rating assigned

Q58: A permanent increase of borrowing by the

Q90: A stock has a current annual dividend

Q92: The risk spread on bonds fluctuates mainly

Q93: What price would an individual be willing

Q108: Consider a one-year corporate bond that has

Q118: Which of the following statements is most

Q122: The reason for the increase in inflation