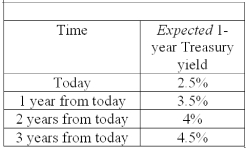

Using the information provided and the expectations hypothesis, compute the yields for a two-year, three-year, and four-year bonds.

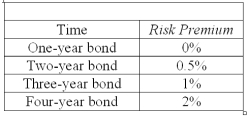

Now, suppose there is a risk premium attached to each bond. These risk premiums are given in the table below:

Using the information above and the liquidity premium theory, compute the yields for a two- year, three-year, and four-year bonds. How does this yield curve compare to the one you computed using the expectations hypothesis?

Definitions:

Cost Per Click

A digital advertising metric that measures the amount paid by an advertiser for each click on their advertising link.

Advertiser's Website

The online platform owned or used by an advertiser to provide information about their brand, products, or services, and engage with customers.

Online Sales

Transactions that occur over the internet where goods or services are bought and sold through websites or online marketplaces.

Performance Measure

Metrics used to evaluate the effectiveness, efficiency, and progress of a project or employee towards achieving objectives.

Q3: The market for bonds is initially described

Q8: An investor deposits $400 into a bank

Q13: Farou invests $2,000 at 8% interest. About

Q43: The time value of the option can

Q45: Considering foreign exchange transactions:<br>A) the U.S. dollar

Q60: Financial intermediaries reduce the problems in lending

Q78: The most broadly based stock index in

Q105: An investment pays $1,000 three quarters of

Q121: People differ on the method by which

Q123: We would expect the relationship between the