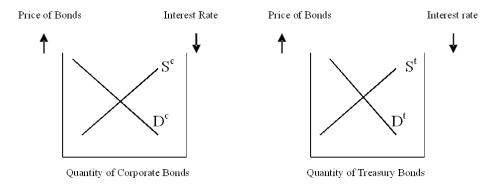

Please use the graphs to show what happens to the risk (yield) differential in each situation and why.

Assume the corporate and Treasury bonds have the same maturity;

a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?

b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?

c) If the corporate bonds are granted tax-exempt status, what happens in each market?

d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

Definitions:

Common Stock

A type of equity security that represents ownership in a corporation, with rights to vote on corporate matters and receive dividends.

Market Price

The existing rate for buying or selling a product or service in a market environment.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term financial health.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year, calculated by dividing current assets by current liabilities.

Q21: Large, advanced economies like the United States,

Q28: Users of commodities are:<br>A) usually not participants

Q40: Tom buys a futures contract for U.S.

Q45: An investor who purchases a call option

Q54: Trading in electronic exchanges has grown tremendously

Q61: Suppose that a bond is purchased at

Q75: What is the present value of $200

Q98: The expectations hypothesis suggests the:<br>A) yield curve

Q101: Under the expectations hypothesis of the term

Q112: Explain why holding period return, as an