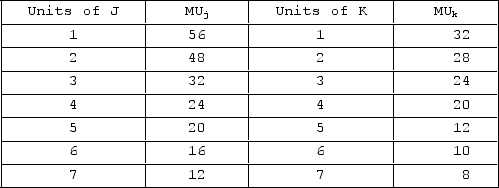

Answer the question on the basis of the following two schedules, which show the amounts of additional satisfaction (marginal utility) that a consumer would get from successive quantities of products J and K.  If the consumer has money income of $52 and the prices of J and K are $8 and $4 respectively, the consumer will maximize her utility by purchasing

If the consumer has money income of $52 and the prices of J and K are $8 and $4 respectively, the consumer will maximize her utility by purchasing

Definitions:

LEAPS

Long-Term Equity Anticipation Securities, which are options contracts with expiration dates longer than one year, offering longer-term investment strategies.

Initial Maturities

The original duration until the expiration or due date of a financial instrument, such as a bond or loan, when first issued.

Exchange-Traded Options

Financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific amount of a security at a set price on or before a certain date.

Call Contract

An options contract that gives the holder the right to buy an underlying asset at a specified price within a certain time frame.

Q36: What is the ultimatum game?

Q56: A 10 percent increase in the price

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Suppose you have

Q166: Airlines charge business travelers more than leisure

Q169: 3-D printers can reduce the cost of

Q200: The availability heuristic refers to people purchasing

Q257: Riley has a new tennis racket for

Q271: Neoclassical economic analysis tends to disregard the

Q354: Prashanth decides to buy a $75 ticket

Q377: The Illinois Central Railroad once asked the