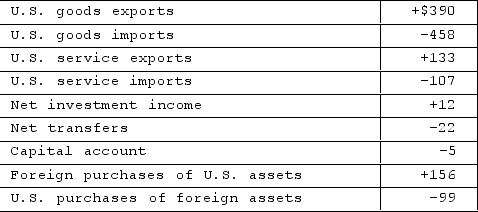

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

The accompanying table contains hypothetical data for the U.S. balance of payments in a year. All figures are in billions of dollars. The balance on the financial account was a

Definitions:

Schedule D

A form used with the U.S. federal income tax return to report capital gains and losses from the sale, exchange, or disposition of capital assets.

Mortgage Interest

The interest charged on a loan used to purchase a residence, which can be deductible for taxpayers who itemize deductions on their income tax returns.

Property Taxes

Taxes assessed on real estate by local government, based on the property's assessed value.

Depreciation

The accounting method of allocating the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

Q37: With flexible exchange rates, an increase in

Q71: Economic growth may hinge on whether individuals

Q117: Which of the following is not a

Q143: Consider the currency market for British pounds

Q148: Developing countries (DVCs)can be subdivided into the

Q153: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying diagram

Q160: In terms of the circular flow diagram,

Q190: "Consumer sovereignty" means that<br>A)buyers can dictate the

Q198: Nations belonging to a common currency<br>A)lose the

Q290: Offshoring benefits some firms by reducing their