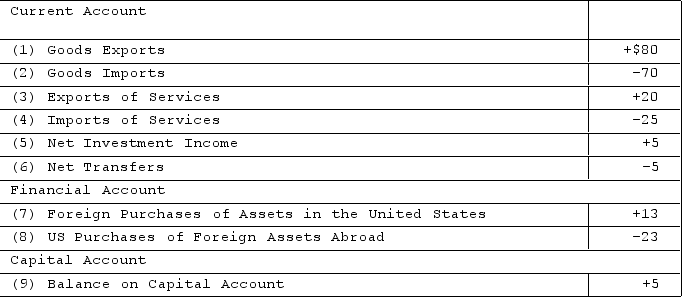

The table contains balance of payments data (+ and −) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on the capital and financial account shows a

The table contains balance of payments data (+ and −) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on the capital and financial account shows a

Definitions:

Lump-Sum Tax Rate

A tax that is a fixed amount, no matter the change in circumstance of the taxed entity. This creates a situation where the tax burden falls more heavily on those with lower income or profit.

Marginal Tax Rate

The amount of tax applied to an additional dollar of income, often used in progressive tax systems.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressing the percentage of income that is paid in taxes.

Income

Monetary payment received for work, from investments, or from government benefits, contributing to an individual's wealth.

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Which of the

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying tables

Q139: Suppose that the Mexican government decides to

Q146: The building of a new factory by

Q181: Which of the following is not a

Q218: Providing poor families with grants if they

Q219: In the circular flow diagram, households get

Q235: To stimulate economic growth, it would be

Q251: Capitalism gets its name from the fact

Q274: In what type of business do the