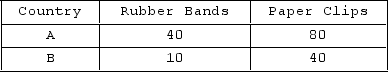

If countries A and B produce only either rubber bands or paper clips, their maximum outputs are shown in the accompanying production possibilities schedules. In country B the opportunity cost of 1 rubber band is

Definitions:

Tax Incidence

The distribution of tax burden among taxpayers; who ultimately pays the tax.

Marginal Tax Rate

The percentage of each additional dollar of income that goes to the tax.

Regressive

A term used to describe a tax system in which the tax rate decreases as the taxpayer's income increases, placing a larger burden on lower-income earners.

Ability-to-Pay Principle

A taxation principle that argues taxes should be levied according to an individual's or entity's capability to bear the tax burden.

Q22: Income gains in the poorest DVCs may

Q95: The current monetary system for conducting international

Q119: In 2017, China overtook Mexico to become

Q153: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying diagram

Q172: Remittances of Mexican workers in the U.S.

Q204: Fixed exchange rates are often maintained by

Q207: Effectively removing all illegal immigrants from U.S.

Q225: As it relates to migration, self-selection is

Q262: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying table

Q276: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the