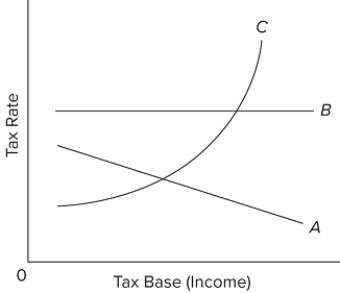

Refer to the graph. The relationship between the average tax rate and the tax base in a proportional tax would be represented by

Refer to the graph. The relationship between the average tax rate and the tax base in a proportional tax would be represented by

Definitions:

Equipment Depreciation

The process of allocating the cost of tangible assets over their useful lives, reflecting the decrease in value of equipment over time.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on their usage of those costs.

Indirect Labor

Labor costs not directly associated with the production of goods or services, such as supervisory or maintenance labor.

Equipment Expense

Equipment expense refers to the cost associated with purchasing, maintaining, and using equipment in a business operation, usually accounted for over the equipment's useful life.

Q9: The decision on the DuPont cellophane case

Q17: Because economic generalizations are simplifications from reality,

Q46: Government borrowing<br>A)is the primary means of financing

Q53: Scarcity<br>A)persists only because countries have failed to

Q68: Which act specifically outlawed price discrimination when

Q132: Which of the following is least likely

Q169: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q180: The federal payroll (Social Security)tax<br>A)increases the progressivity

Q208: The fact that high-income earners tend to

Q218: Which generalization is incorrect?<br>A)Given supply, the more