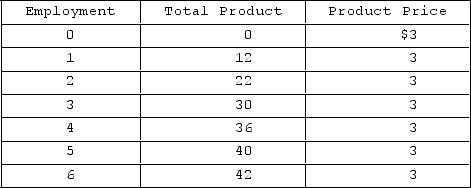

Refer to the given table. If the firm is hiring workers under purely competitive conditions at a wage rate of $22, it will employ

Refer to the given table. If the firm is hiring workers under purely competitive conditions at a wage rate of $22, it will employ

Definitions:

Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Nondiversifiable Risk

Risk that cannot be eliminated by investing in many projects or by holding the stocks of many companies.

Diversifiable Risk

Risk that can be eliminated either by investing in many projects or by holding the stocks of many companies.

Expected Return

Expected return is the anticipated profit or loss from an investment, factoring in all possible outcomes weighted by their probabilities.

Q67: Minimum wage laws have contributed to higher

Q71: Which of the following is a valid

Q96: Entrepreneurs and innovative firms with past successes

Q129: The marginal product of labor and the

Q148: The amount to which some current amount

Q178: As related to businesses, the term "research

Q197: Usury laws<br>A)allocate funds from low-productivity to high-productivity

Q288: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q341: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Wayne's Jacket Shop

Q352: When they were first introduced, ATMs<br>A)were a