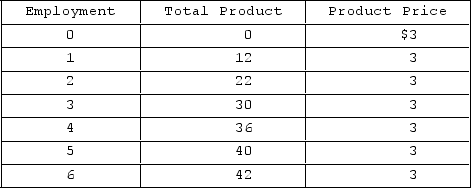

Refer to the given table. Which of the following best represents the labor demand schedule for this firm?

Refer to the given table. Which of the following best represents the labor demand schedule for this firm?

Definitions:

Marginal Tax Rates

The rate at which the last dollar of income is taxed, showing the percentage of tax applied to your income for each tax bracket.

Total Tax

The comprehensive sum of all taxes a person or entity is liable to pay, including federal, state, local, and other forms of taxes.

Provincial Tax Brackets

The divisions at which tax rates change in a progressive tax system within specific provinces or territories.

Non-Eligible Dividends

Dividends that do not qualify for the dividend tax credit in certain jurisdictions, typically paid by companies that pay tax at a rate that is lower than the standard corporate tax rate.

Q10: Large, well-established firms are more likely to

Q28: A firm operating in a purely competitive

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Use the graph

Q86: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows

Q161: Government monetary authorities manipulate the supply of

Q177: The marginal revenue product of labor is

Q217: As pizza topped with barbecue chicken became

Q278: Which of the following does not explain

Q289: Two resource inputs, capital and labor, are