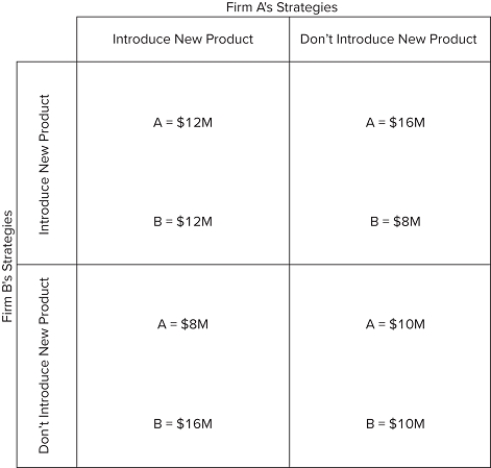

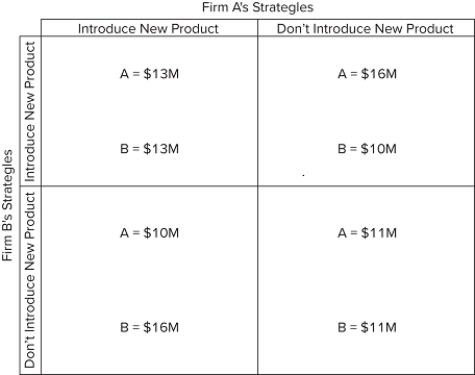

Answer the question based on the payoff matrices for a repeated game involving two firms that are considering introducing new products to the market. The numbers indicate the profit from following either a strategy to introduce a new product or a strategy to not introduce a new product.First game.  Second game.

Second game.  In the second game,

In the second game,

Definitions:

Look-Back Period

A specified time frame in the past during which relevant financial transactions or performance is reviewed or analyzed.

Payroll Tax Expense

Taxes that are incurred by an employer based on the salaries and wages of employees, including taxes like Social Security and Medicare in the United States.

FICA

The Federal Insurance Contributions Act tax is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare.

SUTA

State Unemployment Tax Act; a tax paid by employers at a state level to fund unemployment benefits for workers who lose their jobs.

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q44: As it relates to oligopoly, game theory

Q45: Limit pricing by a price leader in

Q66: If the several oligopolistic firms that compose

Q100: Answer the question on the basis of

Q116: Which of the following characteristics provide a

Q187: Answer the question on the basis of

Q232: A pure monopolist is producing an output

Q324: A breakdown in price leadership leading to

Q362: Answer the question on the basis of