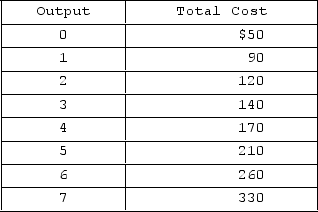

The accompanying table gives cost data for a firm that is selling in a purely competitive market. If product price is $60, the firm will

The accompanying table gives cost data for a firm that is selling in a purely competitive market. If product price is $60, the firm will

Definitions:

FIFO

An inventory valuation method where the first items placed into inventory are the first ones sold (First In, First Out).

LIFO

Stands for Last In, First Out, an inventory valuation method which assumes that the last items placed in inventory are sold first.

Financial Statement

Documented records that outline the financial activities and condition of a business, individual, or other entity.

LIFO Reserve

The difference between the cost of inventory calculated under the LIFO method and its cost calculated under the FIFO method.

Q3: Use the total wage bill rules and

Q3: Describe and explain the cyclic changes that

Q10: Given the data in Table A, complete

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying graph

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Curve (4)in the

Q75: The theory of creative destruction was advanced

Q122: 8n + 4 > 7n + 7<br>A)

Q161: How would a purely competitive industry adjust

Q169: So-called creative destruction leads to all of