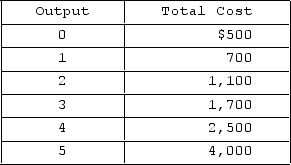

The table shows the total costs for a purely competitive firm. If the product sells for $600 a unit, the firm's short run profit-maximizing (or loss-minimizing) output is

The table shows the total costs for a purely competitive firm. If the product sells for $600 a unit, the firm's short run profit-maximizing (or loss-minimizing) output is

Definitions:

Denominator Level

In cost accounting, it refers to the total amount of allocation base (e.g., direct labor hours, machine hours) that is used to calculate the predetermined overhead rate.

Standard Cost System

A cost accounting method that assigns expected costs to products to help in setting budgets and analyzing cost variances.

Volume Variance

The variance that arises whenever the standard hours allowed for the actual output of a period are different from the denominator activity level that was used to compute the predetermined overhead rate. It is computed by multiplying the fixed component of the predetermined overhead rate by the difference between the denominator hours and the standard hours allowed for the actual output.

Variable Manufacturing Overhead

Costs that fluctuate with production volume, such as indirect materials, indirect labor, and other expenses that increase or decrease as production levels change.

Q1: What has been the general secular trend

Q4: Critically evaluate each of these statements:<br>a. "The

Q7: "Only that portion of the MP curve

Q14: Price discrimination is<br>A)always legal.<br>B)always illegal.<br>C)only illegal if

Q80: A purely competitive firm's short-run supply curve

Q108: As long as an additional unit of

Q146: In purely competitive market, the entry and

Q246: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The accompanying table

Q250: In the standard model of pure competition,

Q268: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the