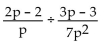

Divide and simplify.

-

Definitions:

Monopoly Firms

Companies that are the sole providers of a product or service in a market, having no close substitutes and controlling market prices.

Higher Prices

Higher prices refer to an increase in the cost of goods or services, often reflecting changes in supply and demand, production costs, or inflation.

Price Discrimination

A pricing strategy where identical or substantially similar goods or services are sold at different prices by the same provider in different markets or to different customers.

Control Resale

Policies or measures designed to regulate or restrict the resale of products or assets.

Q88: Use the following graph to solve <img

Q94: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A) 1, 56

Q128: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q153: Domain: All students attending the University of

Q156: The volume of wood in a tree

Q168: t(2 - m) + s(2 - m)<br>A)

Q172: 19, -4<br>A) 23<br>B) 15<br>C) -23<br>D) -15

Q280: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q303: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A) -1 B)

Q390: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)