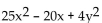

Factor completely.

-

Definitions:

Taxable Income

The portion of an individual's or entity's income used to calculate how much tax they owe to the government, after deductions and exemptions.

Regressive

Relating to a tax system in which the tax rate decreases as the taxable amount increases, often considered less fair to lower-income individuals.

Progressive

Pertaining to ideas, policies, or attitudes favoring progress, change, improvement, or reform, particularly in social conditions.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by total income.

Q77: For <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="For ,

Q79: f(x) = -2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="f(x) =

Q114: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A) b =

Q128: y varies jointly as x and z,

Q154: -8h + 9x - n<br>A) -8, 9,

Q154: At a fixed temperature, the resistance R

Q162: -3m - 9t - b<br>A) -3, 9,

Q191: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A) None of

Q201: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" - 44, when

Q386: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)