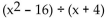

Perform the division.

-

Definitions:

Asset Impairment Test

A procedure carried out to determine if an asset's carrying amount is not recoverable and exceeds its fair value, necessitating a write-down to its fair value.

Deferred Tax Asset

A tax benefit stemming from temporary differences between accounting and tax calculations, which will result in deductible amounts in future tax payments.

Intraperiod Tax Allocation

The apportionment of tax expense or benefit among the different parts of an entity’s financial statements, such as continuing operations and discontinued operations, within the same fiscal period.

Q17: 49 = -7k<br>A) -7<br>B) 1<br>C) 56<br>D) -56

Q38: If the distance from the earth to

Q88: 3x + y = 18; (5, 3)<br>

Q105: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" " class="answers-bank-image

Q154: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A) (9, 0),

Q204: 0.0000000120014<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="0.0000000120014 A)

Q224: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q258: Given f(x) = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="Given f(x)

Q273: -7a = 35<br>A) -5<br>B) -42<br>C) 42<br>D) 1

Q339: 0.00003311<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="0.00003311 A)