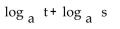

Express as a single logarithm.

-

Definitions:

AGI

Refers to Adjusted Gross Income; the calculation that determines how much of your income is taxable after specific deductions are applied.

Estimated Payments

Periodic advance payments of expected tax liability, often required for earners not subject to withholding taxes like self-employed individuals.

Tax Liability

Refers to the total amount of tax that an individual or business is obligated to pay to the government, based on earnings, property ownership, and other taxable income sources.

Social Security Taxes

Taxes collected from employees and employers to fund the Social Security program, providing benefits for retirees, the disabled, and survivors.

Q32: f(x) = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="f(x) =

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q84: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q109: Given the solutions of a quadratic equation,

Q165: Express three consecutive integers, all in terms

Q207: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" = x A)

Q229: 39.2x = 274.4<br>A) 267.4<br>B) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="39.2x

Q248: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q250: A man rode a bicycle for 12