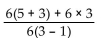

Calculate.

-

Definitions:

Dividend Growth Model

A valuation method used to estimate the value of a stock based on its expected future dividend payments and growth rate.

Dividends

Payments made by a corporation to its shareholders, typically from profits, as a distribution of earnings.

Required Return

The minimum expected return an investor demands for holding a particularly risky investment.

Growth Rate

The rate at which a company's sales, revenue, or other financial metrics increase over a specific period.

Q14: Each branch in a four-branch parallel circuit

Q25: If R1 shorts in Figure 6-2, VR4

Q29: What is one time constant of a

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q45: (4, -6) and (-6, -1)<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg"

Q139: 96%<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt="96% A)

Q157: 0.054<br>A) 54%<br>B) 0.0054%<br>C) 0.054%<br>D) 5.4%

Q215: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8504/.jpg" alt=" A)

Q253: 2.6 + (-6.3)<br>A) 3.7<br>B) -3.7<br>C) -8.9<br>D) 8.9

Q331: -0.89 - 4<br>A) -4.89<br>B) -3.11<br>C) 4.89<br>D) 3.11