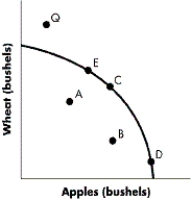

FIGURE 2-11

-Refer to Figure 2-11. Which of the following could make Point Q attainable in the above production possibilities diagram?

Definitions:

Disallowed Loss

A loss that cannot be claimed for tax deduction purposes because it does not meet certain IRS criteria.

Capital Gains

The profit from the sale of assets or investments when the selling price exceeds the original purchase price.

Adjusted Gross Income

An individual's total gross income minus specific deductions. It's used as the basis for calculating taxable income.

Tax-deferred

An investment in which taxes on the principal and/or earnings are delayed until the funds are withdrawn, commonly seen in retirement accounts like 401(k)s and IRAs.

Q2: Which of the following is most likely

Q5: The approximate average bone marrow dose to

Q6: Saudi Arabia has a comparative advantage in

Q12: The tissue weighting factor has a higher

Q54: Which of the following statements about the

Q104: Which of the following statements about the

Q113: What area of economic study is most

Q125: In an effort to fight inflation of

Q196: In a market system, how are decisions

Q204: If Jared declines to purchase a new