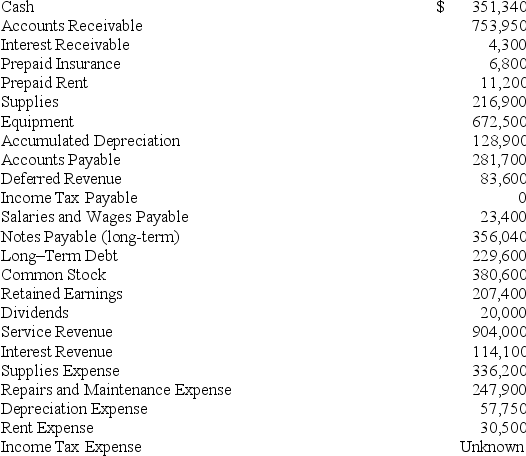

All of the accounts of the Grass is Greener Company have been adjusted as of December 31,2018,with the exception of income taxes incurred but not yet recorded.Those account balances appear below.All have normal balances.The estimated income tax rate for the company is 40%.

Required:

Required:

a.Calculate the income before income tax.

b.Calculate the income tax expense.

c.Calculate the net income.

Definitions:

Liquidation Expenses

Costs associated with the process of winding down a company's business operations and distributing its assets to claimants.

Carrying Amount

The book value of an asset or liability on a company's balance sheet, reflecting adjustments like depreciation or amortization.

Loan Receivable

An amount of money that is loaned to another party in exchange for future repayment of the loan value or principal amount, along with interest or other finance charges.

Journal Entry

A record in accounting that documents a business transaction in the double-entry bookkeeping system.

Q1: The company uses up $5,000 of an

Q12: At the end of the month,the adjusting

Q76: Which of the following requires a credit?<br>A)Decreases

Q109: Decrease in Notes Payable.<br>A)cr<br>B)dr

Q114: Prepaid Rent should be _ and Rent

Q136: Transaction<br>A)The abbreviation for an item posted on

Q146: Which of the following would appear in

Q168: Trudy's Café paid employees $4,680 in September

Q171: Which of the following is not an

Q235: Which of the following statements about the