All of the transactions of Harding Trading Co.for the year have been journalized and posted.The following information has been gathered for the adjustment process as of December 31,2018:

A.The Supplies account shows a balance of $900.A count of supplies revealed $400 on hand.

B.The $1,200 premium relating to a one-year insurance policy was paid on December 1,2018.

C.The company's equipment,which was purchased last year,depreciates at a rate of $1,000 per year.

D.On September 30,2018,a customer paid $10,000 in advance for services;as of December 31,2018,services in the amount of $3,000 had been performed for this customer.

E.Employees are paid $5,000 on Fridays for the 5-day workweek,which ends on that Friday.However,December 31,2018 falls on a Thursday.

F.The company has completed $500 of work for customers;the customers have not yet been billed and the related revenue has not been recorded.

Required:

Part a.Prepare the required adjusting entries required at December 31,2018.

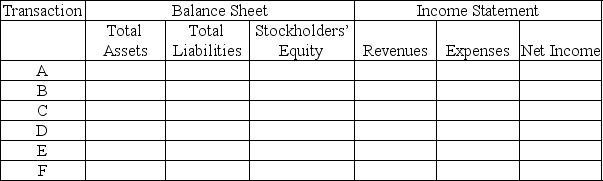

Part b.For each of the adjusting items,indicate the amount and the direction of effects of the adjusting journal entry on the elements of the balance sheet and income statement.Complete the following table by entering the amount and the direction (+ for increase,− for decrease)or leave blank for no effect.

Definitions:

Baseline Data

Initial information gathered before a project or phase of a project begins, used as a reference point for future comparisons.

Nursing Diagnoses

Clinical judgments about individual, family, or community experiences and responses to actual or potential health problems, providing the basis for selecting nursing interventions.

Substernal Chest Pain

Describes pain located beneath the breastbone, often related to heart conditions but can also result from gastrointestinal issues.

Emergency Department

A specialized department in a hospital that provides immediate treatment to patients with acute injuries or illnesses.

Q25: Internal Control<br>A)A set of regulations passed by

Q37: The entry recorded by a law firm

Q68: If total assets decrease,then either total liabilities

Q70: Within the debit/credit framework,the best interpretation of

Q95: Amortization is the concept that applies to

Q156: Accounts Payable<br>A)NCA - Noncurrent Asset<br>B)CL - Current

Q184: Merchandisers record revenue when they:<br>A)fulfill their performance

Q195: Which of the following will happen if

Q212: Accounts Receivable had beginning balance of $8,420

Q219: Which of the following statements is correct