The Dubious Company operates in an industry where all sales are made on account.The company has experienced bad debt losses of 1% of credit sales in prior periods.

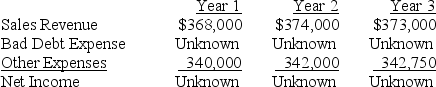

Presented below is the company's forecast of sales and expenses over the next three years.

Required:

Part a.Calculate Bad Debt Expense and net income for each of the three years,assuming uncollectible accounts are estimated as 1.0% of sales.

Part b.Briefly describe the trend in net income changes from Year 1 to Year 2 and from Year 2 to Year 3.

Part c.Assume that the company changes its estimate of uncollectible credit sales to 1.0% in Year 1,2.0% in Year 2 and 1.5% in Year 3.Calculate the Bad Debt Expense and net income for each of the three years under this alternative scenario.

Part d.Briefly describe the trend in net income changes determined in requirement c from Year 1 to Year 2 and Year 2 to Year 3.

Part e.Explain some of the factors that might cause the estimate of uncollectible accounts to vary from year to year (as in the assumption set forth in part c above).

Definitions:

Participant Pool

The group of individuals from which research participants are selected, crucial for the representativeness and validity of a study.

Ethnic Make-Up

The composition of different ethnic groups within a population.

Mean Ages

The average age of individuals in a given population or group.

Result Generalizability

The extent to which research findings are applicable to contexts outside of the original study setting, including different populations and conditions.

Q21: The premium on a bond is _

Q47: The gross profit percentage is the ratio

Q90: The straight-line depreciation method and the double-declining-balance

Q96: The amount of uncollectible accounts at the

Q102: Lexington Company updates its inventory periodically.The company's

Q132: A one-time error in the application of

Q144: Countryside Corporation is owed $11,890 from a

Q172: When the market value of inventory drops

Q173: Because it is easier to use,the direct

Q211: Friedman Company uses the aging of accounts