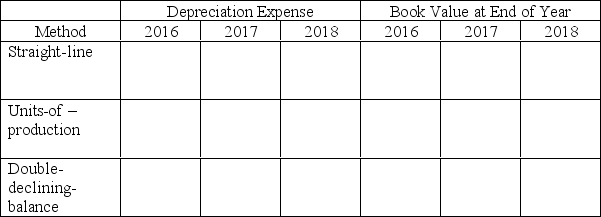

On January 1,2016,Trueblood,Inc.purchased a piece of machinery for use in operations.The total acquisition cost was $33,000.The machine has an estimated useful life of three years and a residual value of $3,000.Assume that units produced by the machine will total 16,000 during 2016,23,000 during 2017,and 21,000 during 2018.

Required:

Part a.Use this information to complete the following table.

Part b.On January 1,2017,the machine was rebuilt at a cost of $7,000.After it was rebuilt,the total estimated life of the machine was increased to five years (from the original estimate of three years)and the residual value to $6,000 (from $3,000).Assume that the company chose the straight-line method for depreciation.Compute the annual depreciation expense after the change in estimates.

Part c.Prepare the adjusting entry to record the depreciation expense for the year ended December 31,2017.

Part d.On December 31,2018,the machine was sold for $7,500.Compute the book value on that date.

Part e.Prepare the journal entry to record the sale.

Definitions:

Slide Thumbnail

A small preview image of a slide in a presentation, used for navigation and to rearrange slides easily.

Normal View

A default screen layout or viewing mode in various software applications, displaying the primary workspace without additional design or layout tools.

Slide Title

The heading or main label of a slide in a presentation that summarizes its content or topic.

Title Text

Text that appears at the top of a document, webpage, or presentation, serving as a heading or the name of the work.

Q3: Countryside Corporation provides $6,000 worth of lawn

Q39: If a company produces the same number

Q58: The entry to record a recovery causes:<br>A)

Q157: All other things being equal,when companies repurchases

Q178: If the receivables turnover ratio rises significantly,the

Q187: The entry to record a bond retirement

Q193: A machine is purchased on January 1,2016,for

Q196: Which of the following statements about stock

Q210: Unearned revenues are liabilities because:<br>A) no cash

Q231: On June 22,2017,Ace Electronics sold an office