On January 1,2016,Trueblood,Inc.purchased a piece of machinery for use in operations.The total acquisition cost was $33,000.The machine has an estimated useful life of three years and a residual value of $3,000.Assume that units produced by the machine will total 16,000 during 2016,23,000 during 2017,and 21,000 during 2018.

Required:

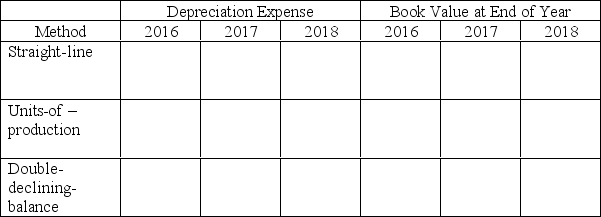

Part a.Use this information to complete the following table.

Part b.On January 1,2017,the machine was rebuilt at a cost of $7,000.After it was rebuilt,the total estimated life of the machine was increased to five years (from the original estimate of three years)and the residual value to $6,000 (from $3,000).Assume that the company chose the straight-line method for depreciation.Compute the annual depreciation expense after the change in estimates.

Part c.Prepare the adjusting entry to record the depreciation expense for the year ended December 31,2017.

Part d.On December 31,2018,the machine was sold for $7,500.Compute the book value on that date.

Part e.Prepare the journal entry to record the sale.

Definitions:

Living Standards

The level of wealth, comfort, material goods, and necessities available to a person or community.

Progressive Tax Structure

A tax system where the tax rate increases as the taxable amount increases, placing a higher burden on wealthier individuals.

Real Incomes

Real incomes refer to the amount of goods and services that can be purchased with a given amount of money, after adjusting for inflation.

Tax Revenues

The money acquired by governments via tax collection.

Q20: When interest is accrued on a note

Q43: Depletion is different from depreciation and amortization

Q67: Use the information above to answer the

Q100: When the amount of a contingent liability

Q100: Choose the appropriate letter to match the

Q128: ABC Corp.received a 3month,at 8% per year,$1,500

Q197: In 2005,ABC Company issued $100,000 of 20-year

Q201: Busy Beaver,Inc.signed a $315,000,5-year note payable to

Q207: Oxford Corporation has 120,000 shares of preferred

Q258: On January 1,2016,Busy Beaver,Inc.signed a $315,000,5year note