Which of the following is not a utility function like the ones shown in the accompanying figure?

Which of the following is not a utility function like the ones shown in the accompanying figure?

Definitions:

Clinical Expertise

The accumulated knowledge, skills, and judgement that healthcare practitioners apply in practice to deliver effective services.

Consciousness Development

The process of expanding self-awareness, understanding, and mindfulness, often through practices such as meditation, reflection, and educational experiences.

Cultural Adaptation

The process of adjusting and adapting one's behavior and attitudes to fit into a different cultural context.

Ethnicity Sensitivity

The awareness and consideration of ethnic cultural differences, ensuring respect and effective communication in diverse social and professional settings.

Q3: _ means the operating system automatically configures

Q7: The term, cracker, originally was a complimentary

Q13: Leo, owner of Leo's Bread Company, recently

Q25: Each employee or customer who uses a

Q29: A _ cell in Excel has a

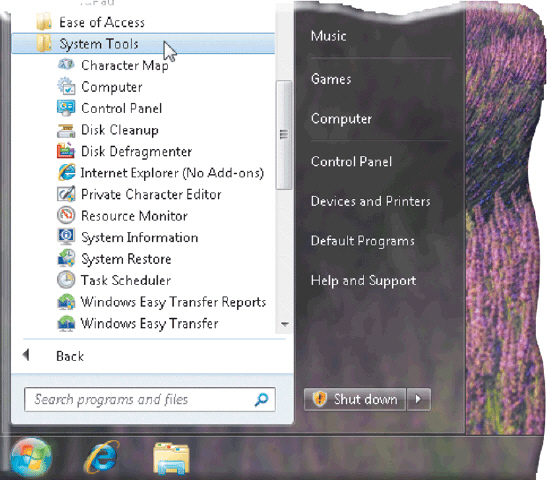

Q33: Some people refer to the series of

Q38: Linux is _ software, which means its

Q57: Excel can display characters in only three

Q73: Podcasters register their podcasts with wikis.

Q92: Moving from left to right, the first