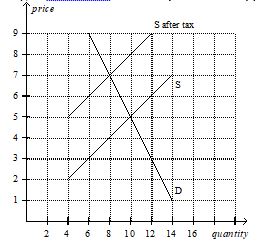

Using the graph shown,answer the following questions.

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

How much will the buyer pay for the product after the tax is imposed?

How much will the seller receive after the tax is imposed?

As a result of the tax,what has happened to the level of market activity?

Definitions:

Hypovolemia

A medical condition characterized by a decrease in the volume of blood plasma in the body.

Diabetes Insipidus

A condition characterized by intense thirst and the excretion of large amounts of urine due to hormonal imbalances affecting water regulation in the body.

Extracellular Fluid

Extracellular fluid refers to the body fluid lying outside the cells, which includes interstitial fluid, blood plasma, and cerebrospinal fluid, playing a crucial role in transporting nutrients, oxygen, and waste products.

Osmometric Thirst

The type of thirst triggered by the body's detection of high solute concentrations in the blood, often leading to the intake of water to dilute these concentrations and maintain osmotic balance.

Q15: Suppose the government has imposed a price

Q25: Which of the following events would increase

Q47: Refer to Table 7-3.If the market price

Q47: To fully understand how taxes affect economic

Q97: If the demand curve is very elastic

Q220: Refer to Figure 7-14.If total surplus is

Q281: Refer to Table 7-6.You have four essentially

Q306: Which of the following would not interfere

Q321: The term tax incidence refers to<br>A) whether

Q393: A payroll tax is a<br>A) fixed number