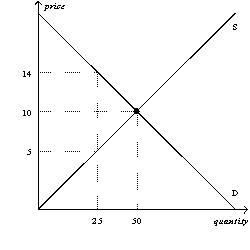

Figure 6-16

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

Definitions:

Unit Product

A specific item or version of a product, distinct in unit size or configuration, produced by a company.

Direct Labor-Hours

The total time workers spend producing a product or performing a service, specifically those directly involved in manufacturing.

Activity-Based Costing

A technique for determining costs that discerns activities in an organization and charges the cost of these activities to all products and services, based on the real amount each consumes.

Unit Product Cost

The total cost incurred to produce a single unit of product, including direct materials, direct labor, and overhead.

Q4: Who bears the majority of a tax

Q6: If the government passes a law requiring

Q34: Refer to Scenario 5-2.Total consumer spending on

Q66: A binding minimum wage may not help

Q124: A price ceiling set below the equilibrium

Q140: In a market,the marginal buyer is the

Q169: Studies by economists have found that a

Q401: Tom tunes pianos in his spare time

Q414: Refer to Figure 6-27.If the government places

Q444: Refer to Figure 6-20.In the after-tax equilibrium,government