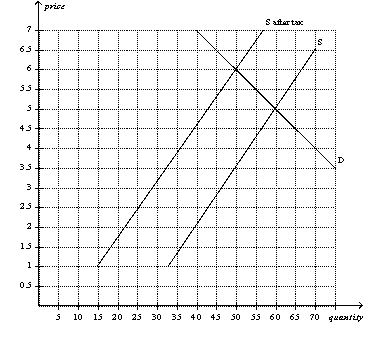

Figure 6-18

-Refer to Figure 6-18.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the buyers of the good,rather than the sellers,are required to pay the tax to the government.After the buyers pay the tax,relative to the case depicted in the figure,the burden on buyers will be

Definitions:

Cash Discount

An incentive offered by sellers to purchasers for paying an invoice promptly, usually defined as a percentage reduction in the invoice amount.

EOQ Model

Economic Order Quantity model; an inventory management method used to determine the optimum order quantity that minimizes the total inventory holding costs and ordering costs.

Shortage Costs

Costs that fall with increases in the level of investment in current assets.

Carrying Costs

Expenses incurred for holding inventory, including storage, insurance, and handling costs.

Q3: Consumer surplus<br>A) is the amount a buyer

Q8: The quantity sold in a market will

Q64: A binding minimum wage creates unemployment.

Q116: When policymakers set prices by legal decree,they

Q207: A price ceiling set above the equilibrium

Q350: A binding price ceiling may not help

Q464: Suppose the government has imposed a price

Q515: Refer to Figure 6-9.At which price would

Q523: The United States is the only country

Q541: Which of the following would be the