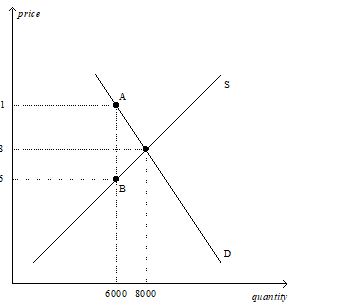

Using the graph shown,in which the vertical distance between points A and B represents the tax in the market,answer the following questions.

a.What was the equilibrium price and quantity in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

f.How much will the seller receive after the tax is imposed?

g.As a result of the tax,what has happened to the level of market activity?

Definitions:

Autonomy

The capacity or right of individuals to make their own decisions freely and independently.

Resiliency

The ability to recover quickly from difficulties; toughness.

HIPAA

The Health Insurance Portability and Accountability Act, a US law designed to provide privacy standards to protect patients' medical records and other health information.

Data Confidentiality

The practice of ensuring that sensitive information is accessible only to those authorized to view it.

Q20: Justin builds fences for a living.Justin's out-of-pocket

Q135: Refer to Figure 6-3.A nonbinding price floor

Q161: Refer to Figure 7-18.Assume demand increases and

Q201: Refer to Table 7-11.Both the demand curve

Q277: A price floor is binding when it

Q307: Inefficiency exists in an economy when a

Q381: The rationing mechanisms that develop under binding

Q416: When a tax is placed on the

Q474: Refer to Figure 6-13.In this market,a minimum

Q524: Refer to Figure 6-18.Buyers pay how much